ARCHIVED - Towards Net-Zero

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Overview of Net-Zero

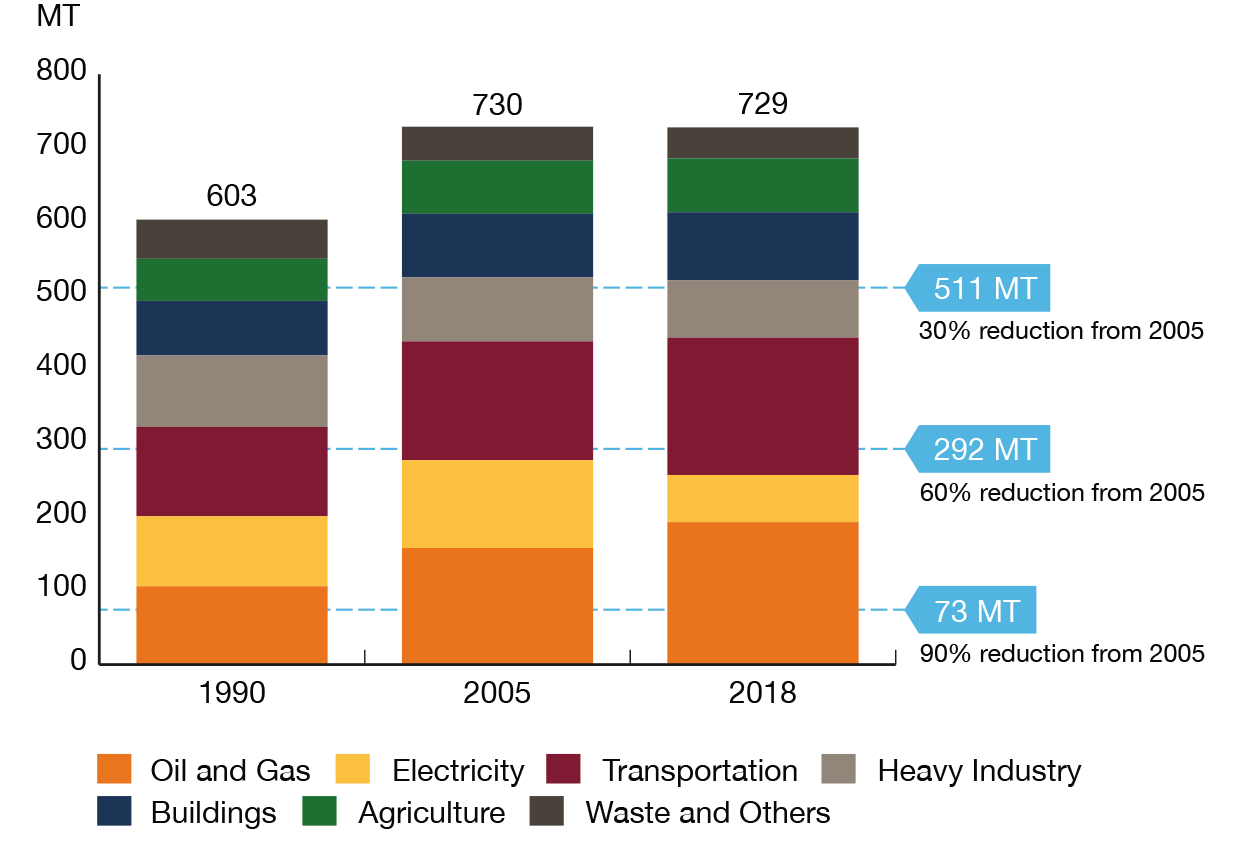

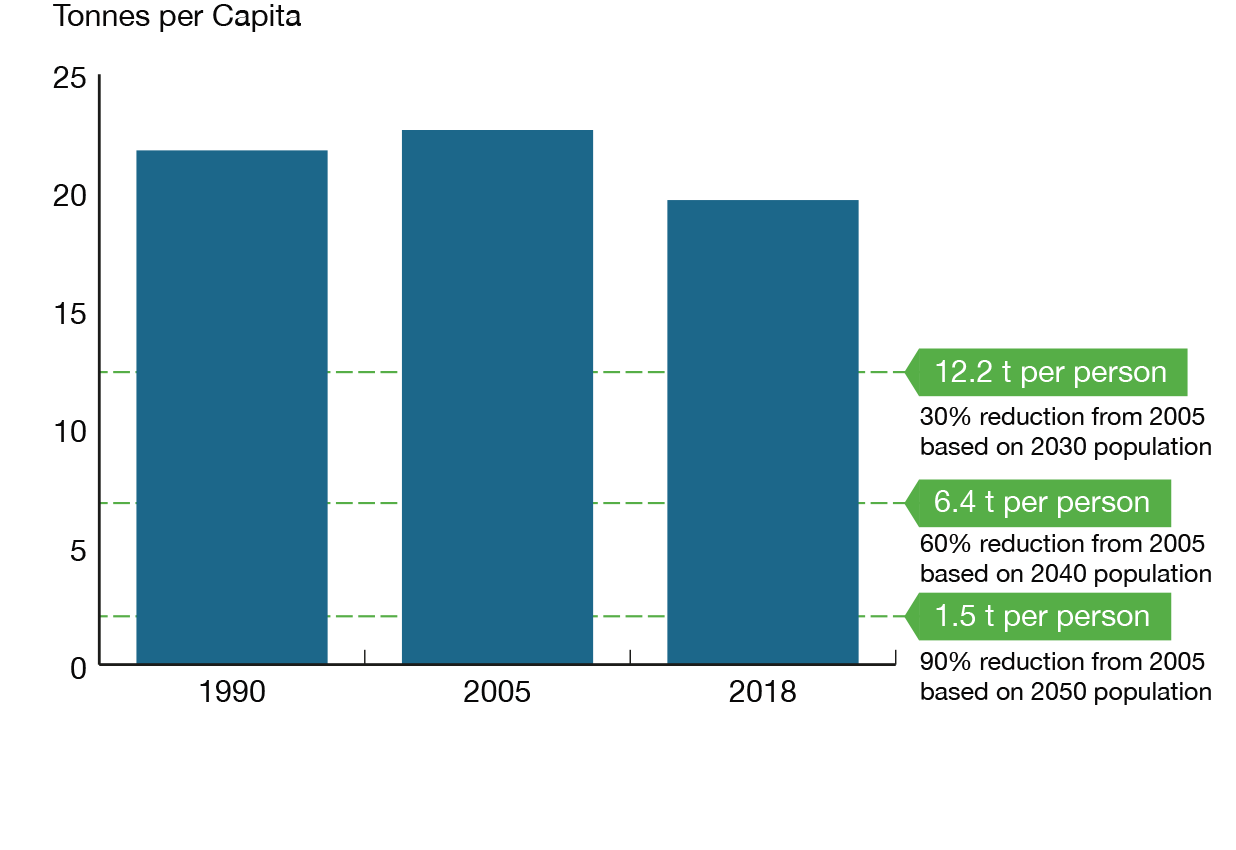

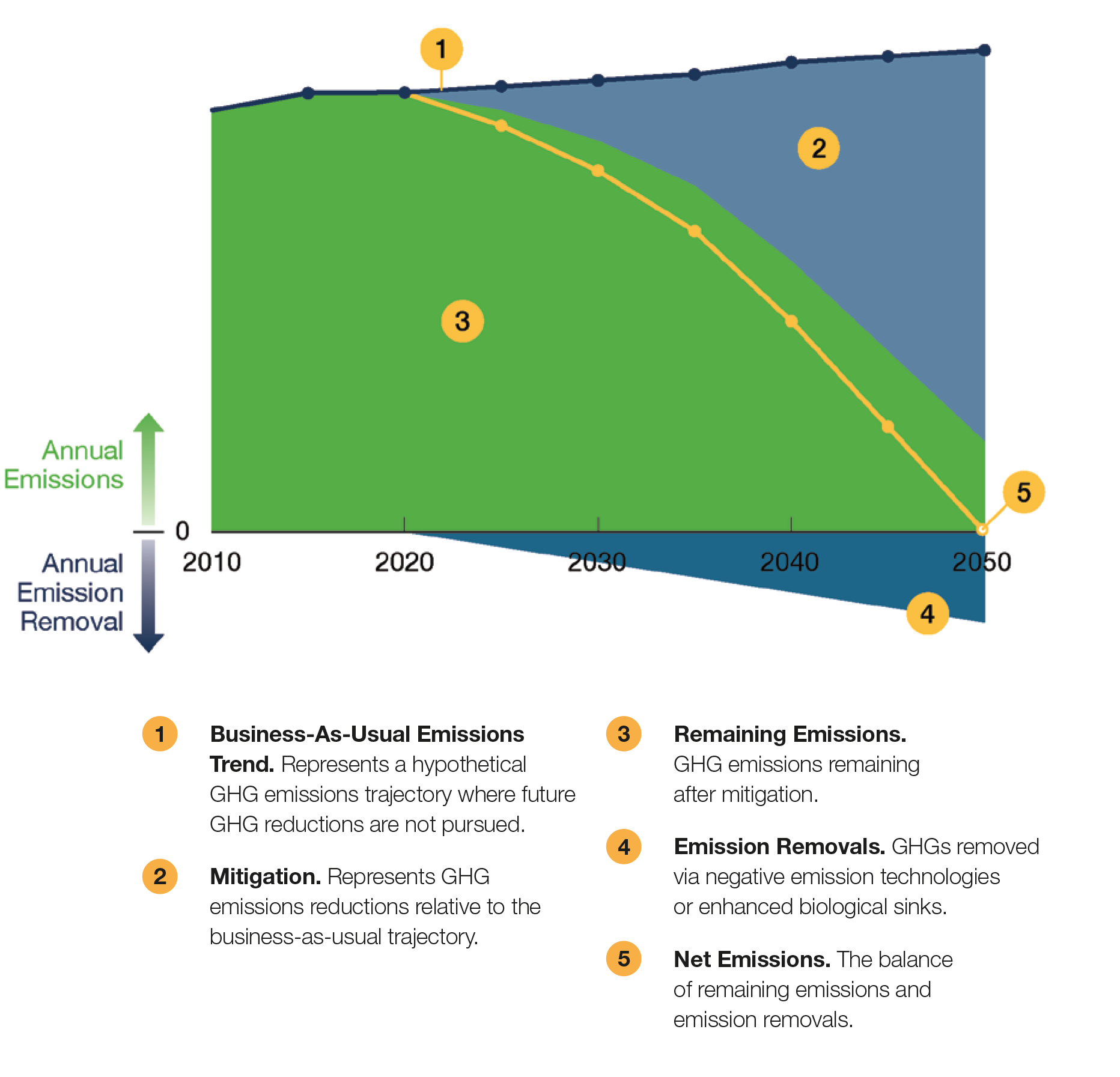

Canada has recently announced more ambitious climate commitments, including exceeding 2030 emission targets and achieving net-zero emissions by 2050. Internationally, momentum towards climate action continues to accelerate, reinforcing the global commitment made in the 2015 Paris Agreement to reach net-zero in the second half of the century.27 Canada’s plan to achieve net-zero emissions by 2050, still under development, will set legally-binding, five year emissions reduction milestones, based on the advice of experts and consultations with Canadians.28

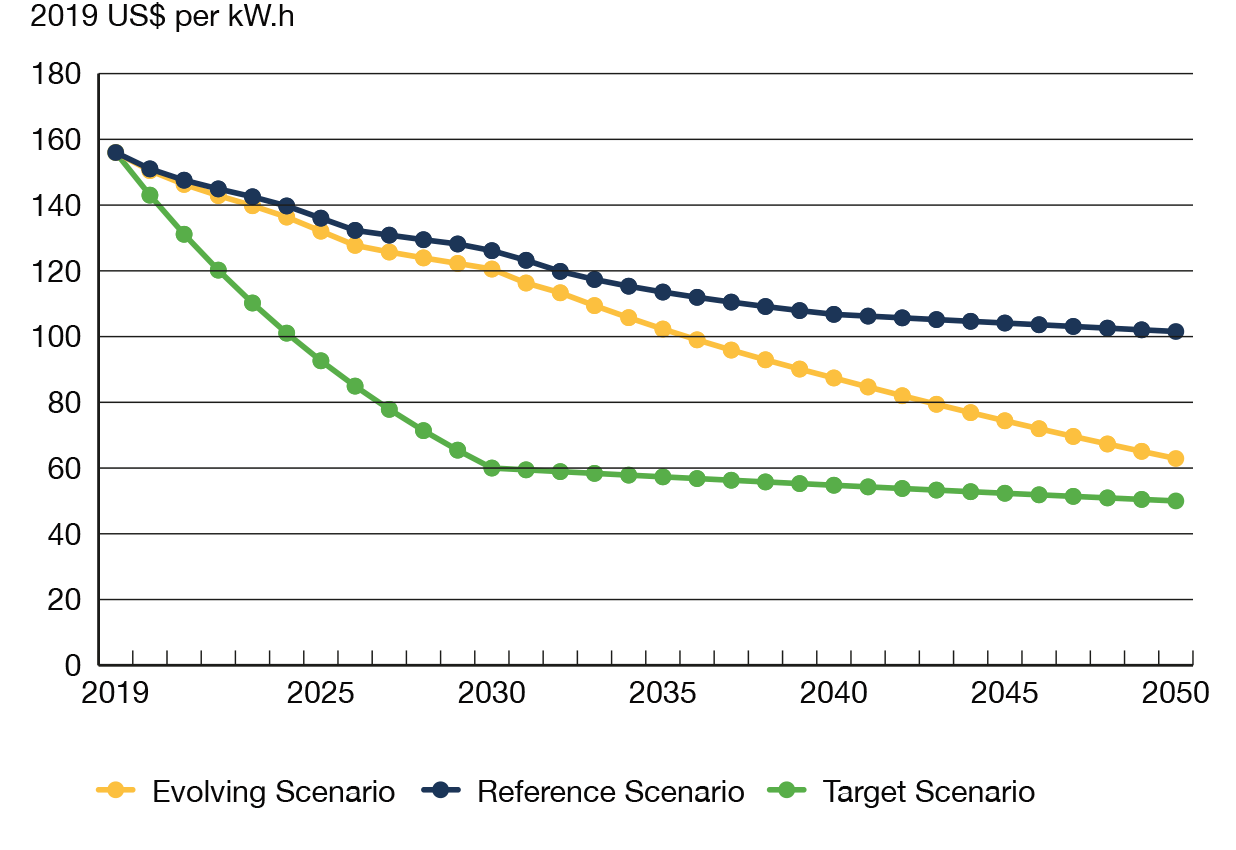

The Evolving Scenario projections in the “Results” section show significant change across the energy system. These changes reflect the core premise of the scenario – climate action continues to develop as Canada keeps with global efforts to proceed towards energy transition. Even though the Evolving Scenario shows a very different energy system than today’s, fossil fuels still make up a majority of Canada’s energy mix by 2050, and are not fully decoupled from emissions via technologies such as carbon capture, utilization and storage (CCUS).

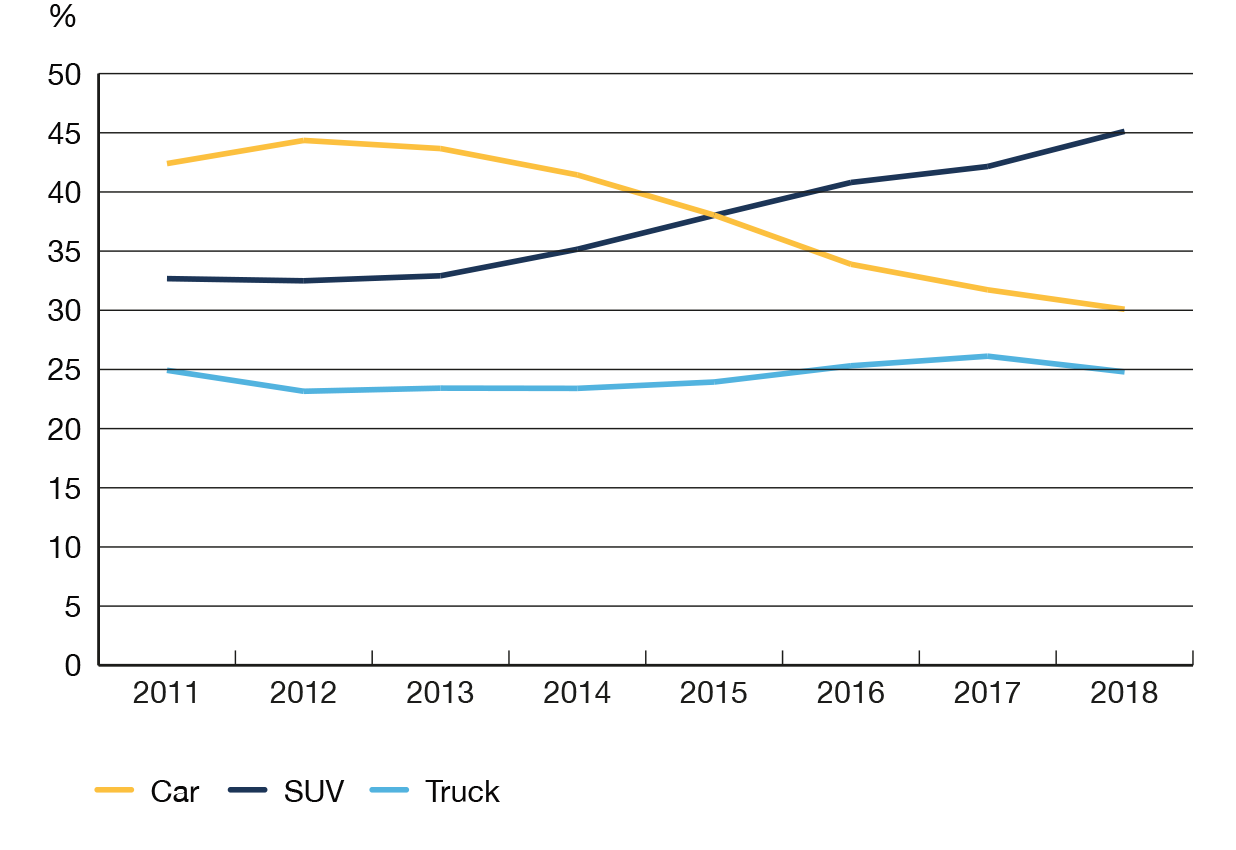

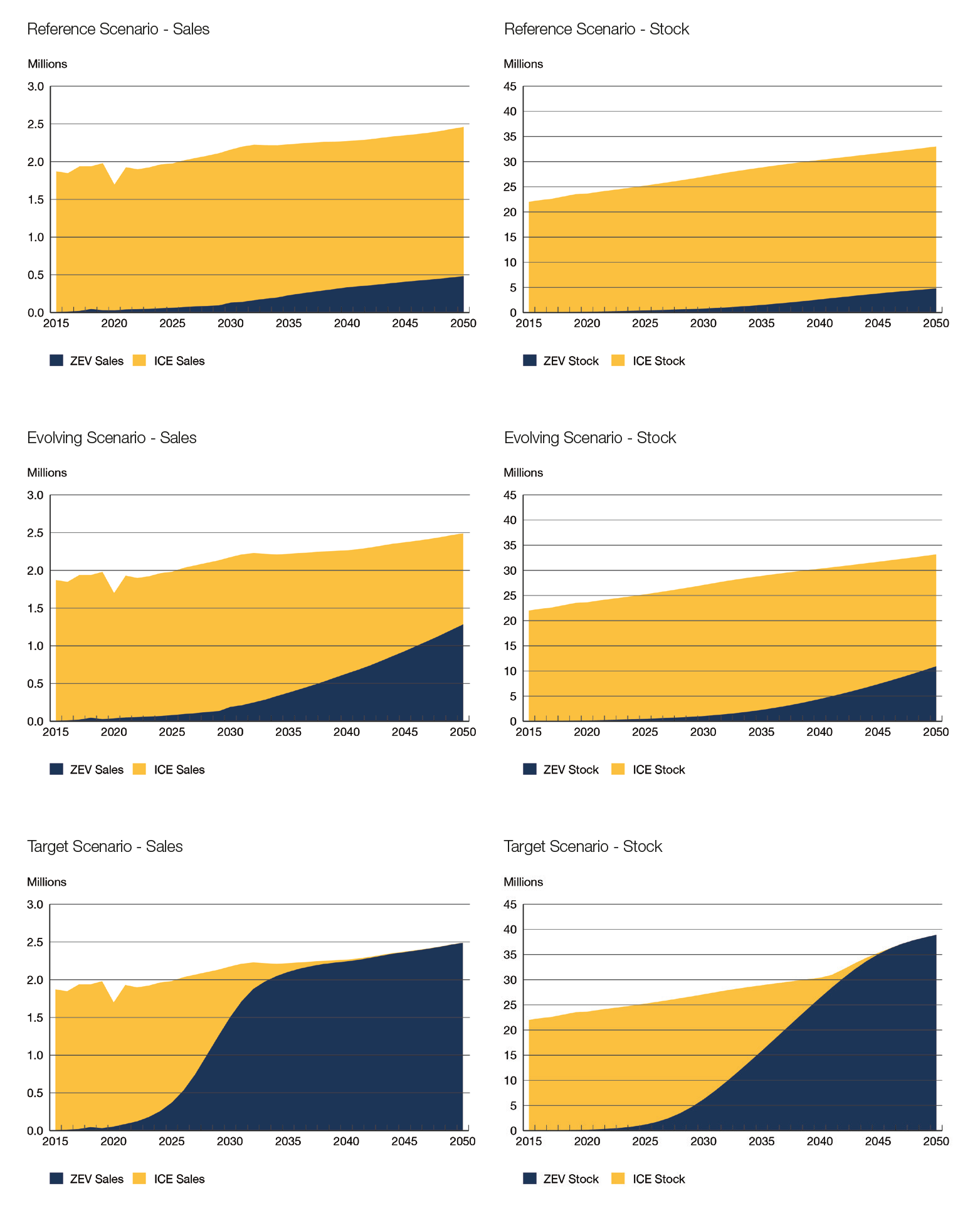

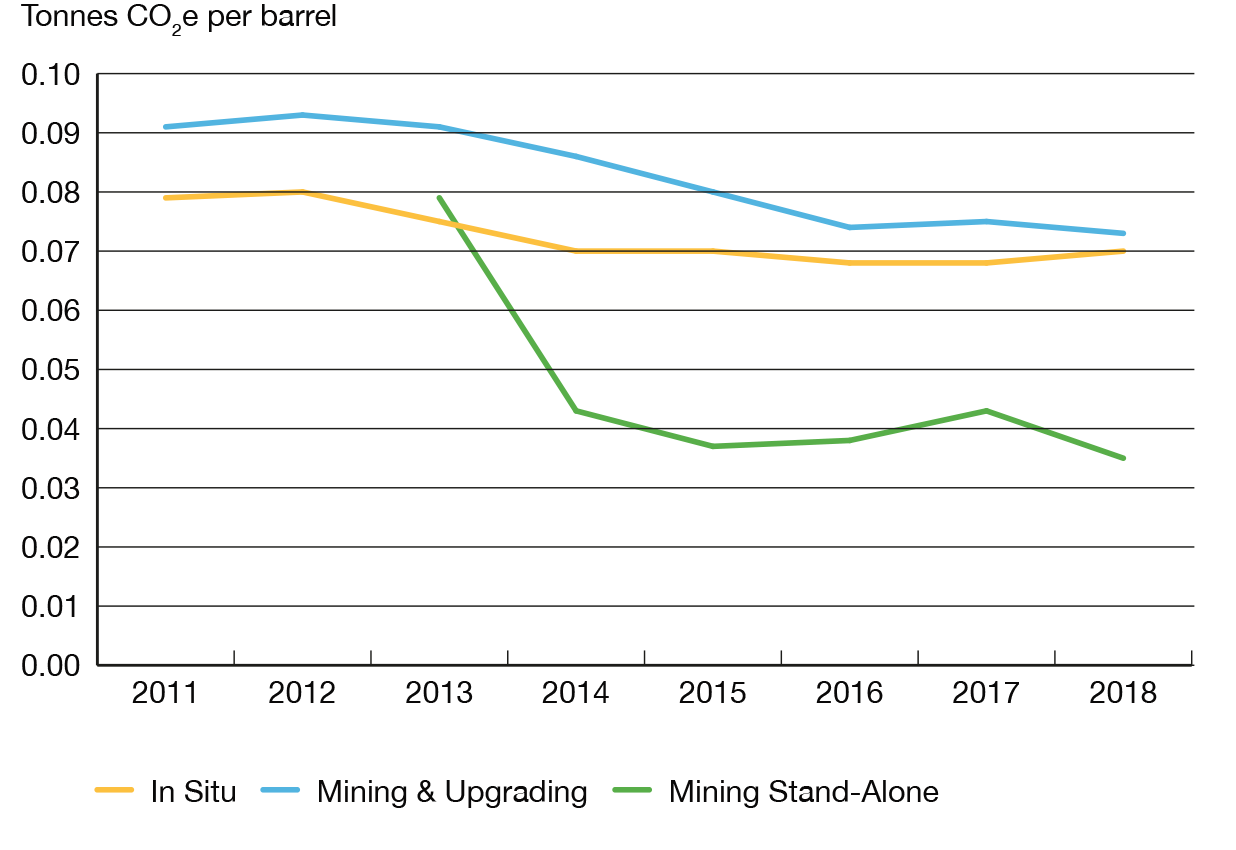

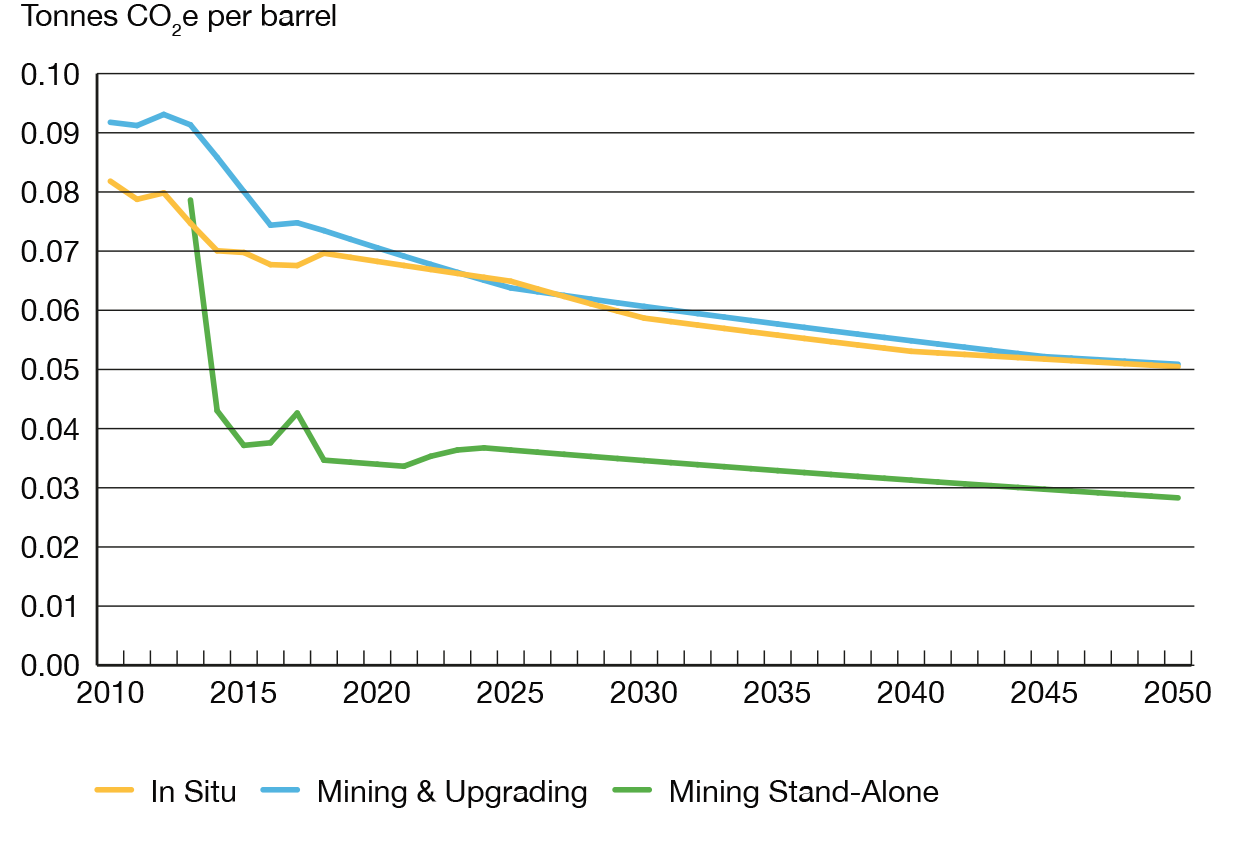

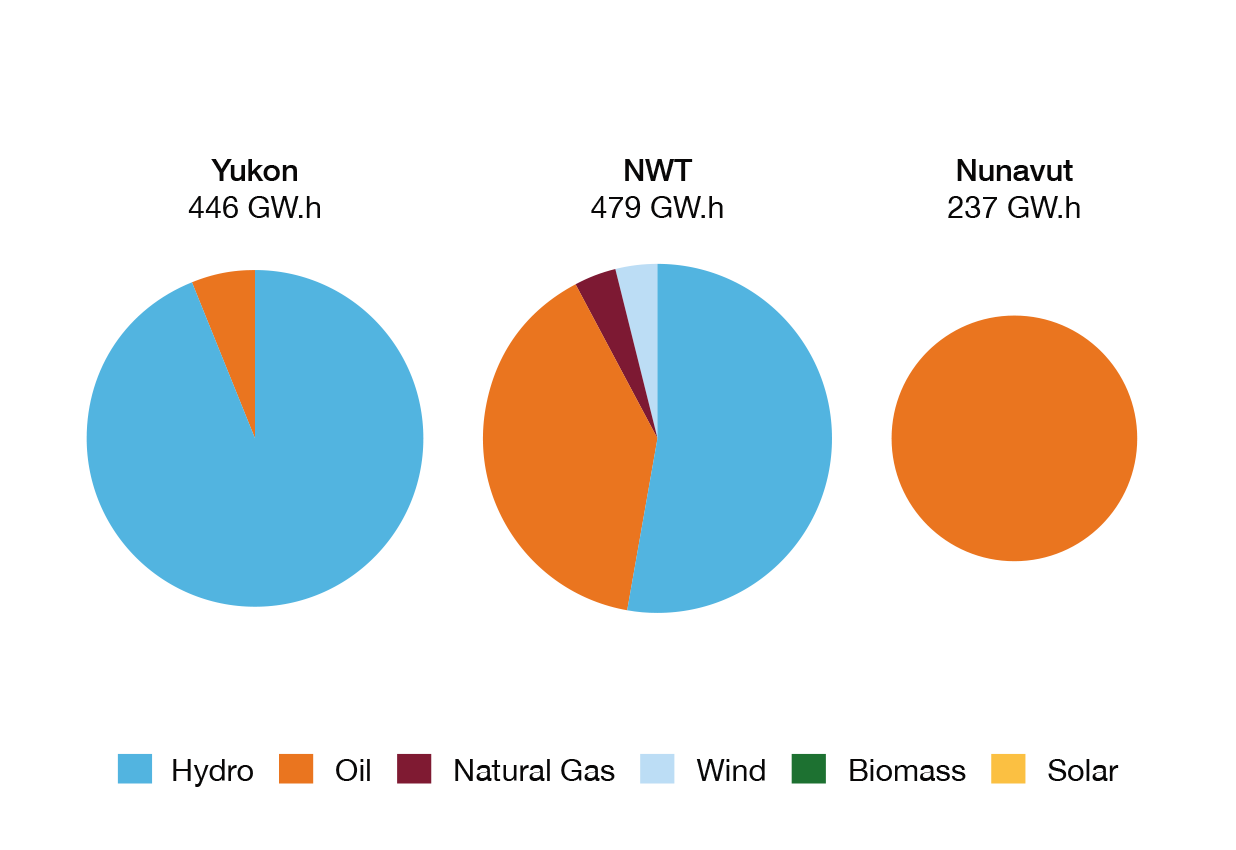

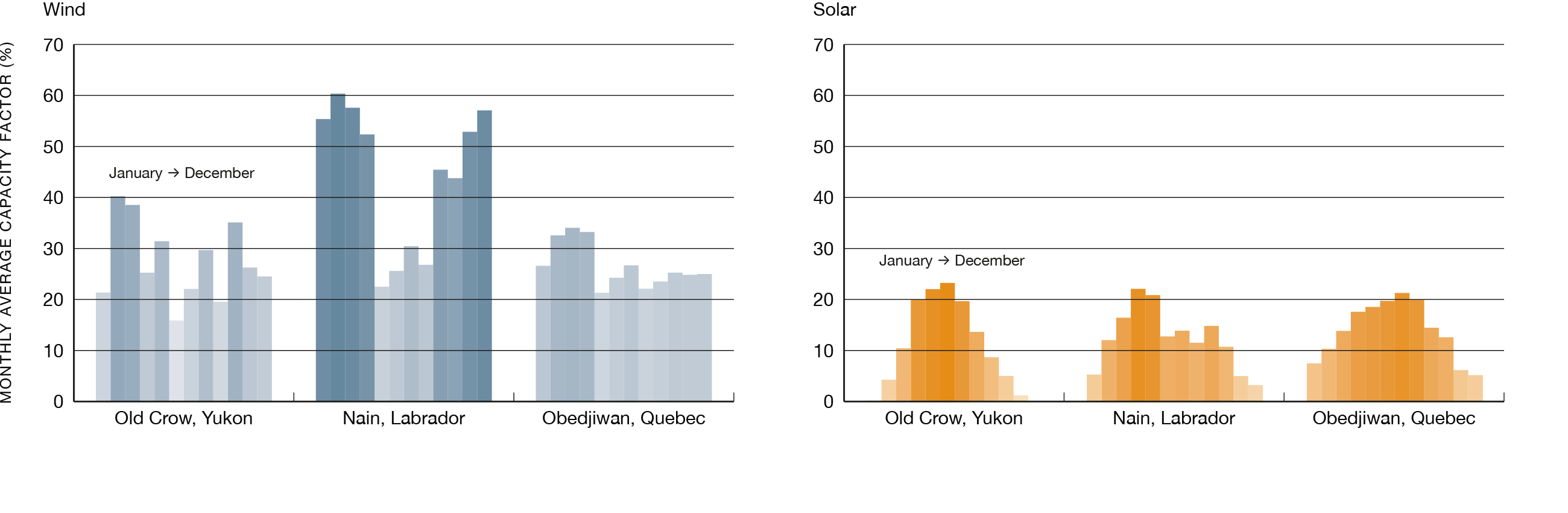

Given that the Evolving Scenario continues the recent pace of change in Canada’s energy transition, the continued reliance on fossil fuels is an important insight. For Canada to meet its 2050 goals, the rate of energy transition will need to increase beyond levels shown in the Evolving Scenario. This section discusses the implications of going beyond the Evolving Scenario, and moving the energy system towards net-zero emissions. Frist we look at what net-zero means. Then, to gain insight into what a net-zero energy transition might mean for different parts of the economy, we focus on three diverse segments of Canada’s energy system: personal passenger transportation, oil sands production, and remote and northern communities. For each segment, we explore its current status, considerations for the segment in the energy transition, and potential pathways and uncertainties in moving towards net-zero.

Description

Description